Market Insight

Loss Aversion: Is Low-Risk Investing Really Low-Risk?

This Article was Written by: Rory Maguire - Fundhouse

Loss Aversion, Low-Risk Investing, Market Insights, Risk, Uncategorised

It is conventional wisdom that investment decisions are usually informed by an assessment of the investor’s willingness to take risk (their risk profile). But what is investment risk?

It is usually defined in two broad ways. First is by looking back at a very similar investment to see how much money it would have lost from peak to trough. Higher historic losses are linked to higher investment risk. Second is the variation or volatility in the return of a similar investment. Smoother returns are seen as safer. These two definitions help explain why investments in listed companies (equities) are seen as high risk – they can fall a lot, and returns are volatile. Lending money to companies and governments (bonds) is seen as lower risk for the opposite reasons. But, what if you lost less money, but it took longer to recover your losses? Is that still lower risk? Next, we compare a low-risk investment (the IA sector 0-35% shares – mostly bonds) to a high-risk investment (the IA Global sectors, which is usually 100% shares). In all cases, equities fall more major market sell-offs:

Source: Fundhouse and Financial Express, Data from 1999 to June 2024

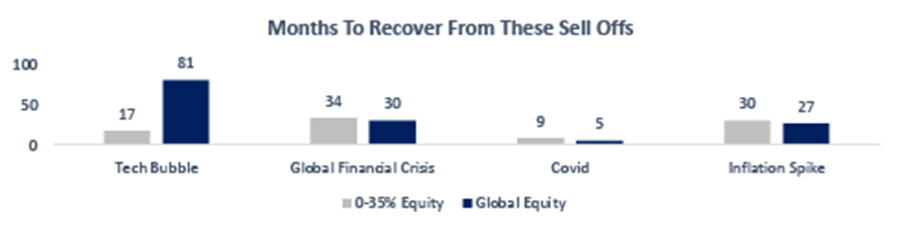

Yet, in all cases, bar one, the next chart shows that higher-risk investments (equities) recovered losses quicker than lower-risk investments (ones that are mostly invested in bonds). Below, we measure the recovery period as the period taken from peak to recovery, not drawdown to recovery. Note that the 0-35% sector has still not recovered from the inflation-driven sell-off in 2024 on the right:

Source: Fundhouse and Financial Express, Data from 1999 to June 2024

Investing is complex, and risk is not always what it seems. When building model portfolios, we are very aware of this risk and ensure that bonds are not simply seen as diversifiers. They must have investment merit.

Fundhouse is the trading name of Fundhouse Bespoke Limited. Fundhouse provides investment management services to professional clients and does not provide financial advice. Importantly, this note does not represent investment advice, and any reader should always speak to their financial adviser before making any investment decisions. Please note that the value of any investment may go down as well as up, and you may lose capital when investing, and the value of your investments may not always increase. Please ensure that you are comfortable bearing financial losses and that you are comfortable taking a long-term investment view of five years or more.