Market Insight

The FCA’s New SDR & Investment Labels Regime – Early Insights

This Article was Written by: Ben Jones - Fundhouse

Uncategorised

On Tuesday, the FCA released a 212-page Policy Statement on Sustainability Disclosure Requirements (SDR) & Investment Labels.

These new rules will impact every UK asset manager and nearly all UK domiciled funds, in one way or another, over the coming months and years. Since the FCA released its consultation paper in October 2022, we have spent considerable time discussing it with fund managers, product designers, regulatory experts, financial advisers, and more. Following an initial read-through of the Statement, we wanted to share some of our early insights with you. Overall, we think that the regulation looks quite fair, pragmatic and generally achievable. Although some aspects of the rules are still to be finalised, the FCA has considered some of the issues raised in the consultation process.

Background

This regulation is borne-out of the FCA’s recognition of a few things. Firstly, sustainable investment has reached mainstream investor interest, with a corresponding growth in funds ready to meet demand. Secondly, investors have found it difficult to match their sustainability preferences with funds, given the unstandardised – and in some cases, misleading – way they are named and marketed. Thirdly, the government needs support to meet its sustainable economic growth goals, and to make UK financial services a sustainability leader; it is notable that the FCA has built a distinct framework here, rather than mirroring EU legislation as it has done in other places.

We are supportive of the aims of the regulation. We have ourselves been critical of the way that ESG has been handled in parts of the industry. Many ESG products have been launched over recent years, enjoying enormous inflows, but the legitimacy of sustainability inside some of these products is questionable. We thought (as did many firms) that the October 2022 consultation paper created impracticalities and gaps that might curtail the sustainable investment marketplace, rather than enable it – but this final paper is a considerable improvement. We think it seems pragmatic and fair to various stakeholders, albeit a few key gaps remain to resolve in future.

Highlights from the new regime – labels and naming rules

Specific labels. Asset managers will now be able to differentiate their funds that are going above-and-beyond in sustainability terms by giving them one of four new specific labels. Only one label can be used per fund, and there is no suggestion that any label is better than another. The labels are defined below:

|  |  |  |

| Fund must have a “positive measurable impact in relation to an environmental and/or social outcome.” | Fund must “aim to invest in assets that are environmentally and/or socially sustainable” | Fund must “aim to invest in assets that have the potential to improve environmental and/or social sustainability over time” | Fund will invest in a blend of assets that meet the criteria for the other three labels |

Source: FCA PS23/16, Fundhouse

To qualify for a label. It is not enough for the portfolio holdings of a fund to simply look and feel sustainable, nor to integrate ESG factors into an investment process. Asset managers must now give the fund an objective upfront, focusing on social or environmental outcomes (notably not ‘governance’ – the ‘G’ in ‘ESG’). They must also do a few things to support that objective.

Now, both the intention and the outcome of the fund should better achieve genuinely sustainable outcomes:

Funds that don’t qualify for labels. For funds that don’t qualify for labels but still have some ESG characteristics, asset managers will still be able to give them names that speak to this – except they cannot use the word ‘sustainable’ or ‘impact’ in their fund names. Similar guidance applies for marketing.

Highlights from the new regime – greenwashing and other topics

Greenwashing. Tying-in closely with Consumer Duty, the FCA proposes an anti-greenwashing rule, covering all regulated firms, products, and services, to ensure that any sustainability-related claims are “clear, fair and not misleading”. It is expected to be strict, with the FCA suggesting that an “image of a rainforest” in the wrong place on a website could fall foul of the rule. More precise details and examples will likely follow, as the FCA will accept feedback on the greenwashing proposals until Jan-end.

Various disclosure rules. Managers must explain if they expect sustainability objectives to negatively affect returns (notably absent today!); various documents must be available to explain sustainable characteristics; large firms must make firm-level disclosures about their sustainable investment activity and resourcing (which we welcome – we have been testing managers on this ourselves for years).

What the paper left to be resolved: MPS providers are out-of-scope for now, with their own consultation to come in 1Q24; the FCA will consult with the Treasury on how to treat overseas domiciled funds; pension products are out of scope; the FCA recognise that financial advisers will need further consulting on how SDR integrates with existing advice regulation.

Source: FCA PS23/16, Fundhouse.

Out of scope: MPS providers and other ‘portfolio management’ services… consultation to follow “early 2024”

What we’re doing about SDR

- Fund research. For over 12m we’ve been in regular dialogue with fund managers on SDR – we’ll continue, and have already reached out to them this week to check their plans, given the final rules.

- Futureproofing our ESG research. We’ll ensure our ESG fund research tools incorporate SDR.

- MPS. We await the 2024 consultation on MPS/discretionary providers. In the meantime, we continue to run our SRI models to high standards, testing funds using our proprietary ESG fund research tools.

- Industry. We’ll continue to have conversations with people across the industry to gauge SDR’s impact.

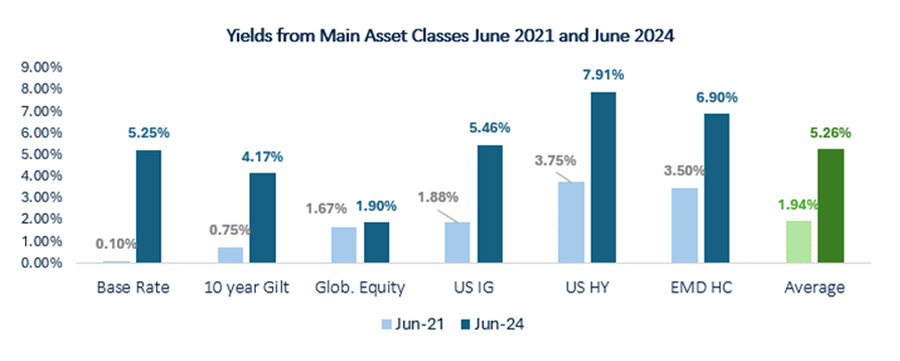

Source: Fundhouse/Refinitiv/Bloomberg. Data as at end June 2021 and June 2024. Available yields are a function of variables like base rates (set by central banks) and the price of assets (high prices offer lower yields and vice versa).

Speak to the team: mps@fundhouse.co.uk.

Fundhouse is the trading name of Fundhouse Bespoke Limited. Fundhouse provides investment management services to professional clients and does not provide financial advice. Importantly, this note does not represent investment advice, and any reader should always speak to their financial adviser before making any investment decisions. Please note that the value of any investment may go down as well as up, and you may lose capital when investing, and the value of your investments may not always increase. Please ensure that you are comfortable bearing financial losses and that you are comfortable taking a long-term investment view of five years or more.