Market Insight

Do UK Elections Impact UK Equities?

This Article was Written by: Rory Maguire - Fundhouse

Market Insights, UK Politics, Uncategorised

Yesterday, it was announced that the UK will hold a general election on July 4th 2024. We can understand how clients may feel concerned about this.

Will the government change? Will economic growth change? Will tax rates change? Will investments be impacted? These are understandable concerns, and we address the latter question in this article.

Impact of General Elections

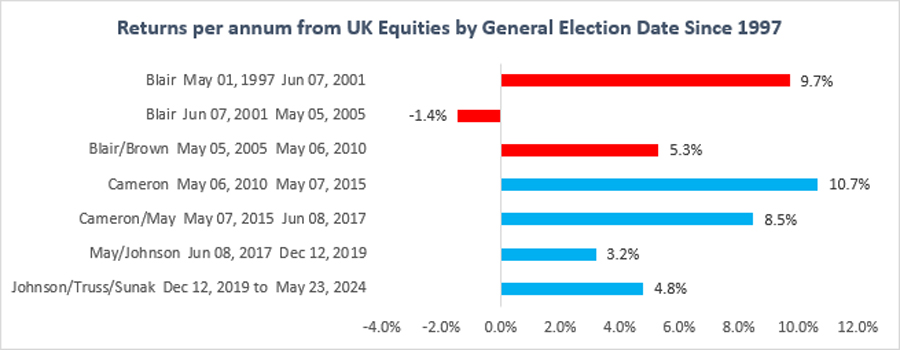

Since Blair was first elected in 1997, we have examined the impact of general elections on the UK equity market. The results are shown below, with Labour in red and Conservatives in blue.

Source: Financial Express, up until 23rd May 2024. The above are per annum in sterling and are based on the performance of a peer group of UK equity fund managers, known as the Investment Association Sector.

Fundhouse Opinion

In our opinion, this shows that both the general election and who is in power does not really matter.

Take Blair. When he came to power, it was during the almighty tech bubble. This is why he had such high returns during his first term and low returns during his second term.

Cameron is another anomaly. His first term saw excellent returns, not because of his policies but because equity markets were rebounding from the Global Financial Crisis that had bottomed the year before. He also presided over the Brexit vote, and yet UK equity markets performed well over this period.

Neither Brexit nor Cameron seemed to matter. What was really driving markets then was a very low-interest rate environment. Then, I suspect you would be surprised to note that the May/Johnson period saw lower returns than the Johnson/Truss/Sunak period. The latter government oversaw the COVID-19 pandemic, and even this global event did not stop equity markets from delivering quite reasonable returns.

Conclusion

What we think really matters is the starting valuation.

If valuations are high (think the tech bubble of 2001), subsequent returns are low. And if valuations are low (think after the Global Financial Crisis in 2009), returns are high. When valuations are reasonable, you receive quite average returns, as was the case in most periods.

Speak to the team: mps@fundhouse.co.uk

Fundhouse is the trading name of Fundhouse Bespoke Limited. Fundhouse provides investment management services to professional clients and does not provide financial advice. Importantly, this note does not represent investment advice, and any reader should always speak to their financial adviser before making any investment decisions. Please note that the value of any investment may go down as well as up, and you may lose capital when investing, and the value of your investments may not always increase. Please ensure that you are comfortable bearing financial losses and that you are comfortable taking a long-term investment view of five years or more.