Market Insight

July 2024 Economic and Market Report

This Article was Written by: Chris Proudfoot - Fundhouse

Economic & Market Report, Market Report

In July, we learned that consumer prices in the UK rose by 2.0% in the 12 months to June – the same inflation rate as in May.

At their 31st July meeting, the Bank of England’s (BoE) Monetary Policy Committee lowered interest rates from 5.25% to 5%, which was significant as interest rates have not been cut since March 2020. BoE governor Andrew Bailey confirmed that… economic and market commentary is available to Financial Advisers via our support site. Please register/login here

We take great pride in producing high-quality content for advisers and hold ourselves accountable to fast response times to adviser queries.

Our investment team members are available to answer questions if needed.

Speak to the team: mps@fundhouse.co.uk

Fundhouse is the trading name of Fundhouse Bespoke Limited. Fundhouse provides investment management services to professional clients and does not provide financial advice. Importantly, this note does not represent investment advice, and any reader should always speak to their financial adviser before making any investment decisions. Please note that the value of any investment may go down as well as up, and you may lose capital when investing, and the value of your investments may not always increase. Please ensure that you are comfortable bearing financial losses and that you are comfortable taking a long-term investment view of five years or more.

More Fundhouse Articles...

July 2024 Economic and Market Report

This Article was Written by: Chris Proudfoot - Fundhouse

Economic & Market Report, Market Report

In March 2024, the FCA concluded a thematic review (TR24/1) into retirement income advice.

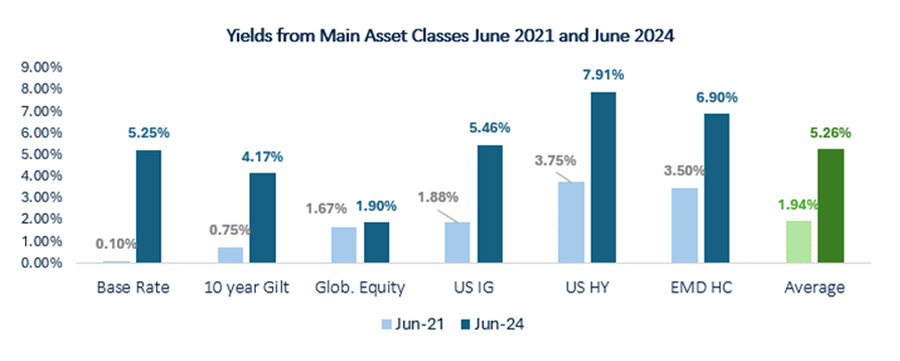

Interestingly, within this review, they found that many advice firms settle on 4% as a ‘sustainable income’ level for end clients. As shown below, at current yields (bold bars), 4% is quite sustainable, although only three years ago (light bars), the average yield was below 2%. Available yields move around a lot. To read the full article, including how Fundhouse approaches income solutions with yields that are so varied, please register/login here

Source: Fundhouse/Refinitiv/Bloomberg. Data as at end June 2021 and June 2024. Available yields are a function of variables like base rates (set by central banks) and the price of assets (high prices offer lower yields and vice versa).

Speak to the team: mps@fundhouse.co.uk.

Fundhouse is the trading name of Fundhouse Bespoke Limited. Fundhouse provides investment management services to professional clients and does not provide financial advice. Importantly, this note does not represent investment advice, and any reader should always speak to their financial adviser before making any investment decisions. Please note that the value of any investment may go down as well as up, and you may lose capital when investing, and the value of your investments may not always increase. Please ensure that you are comfortable bearing financial losses and that you are comfortable taking a long-term investment view of five years or more.