Market Insight

Navigating The Investment Landscape Amidst The Upcoming US Elections

This Article was Written by: Chris Proudfoot - Fundhouse

2024 US Election, Market Insights

The world of politics took a surprising turn over the weekend, as we learnt that US President Joe Biden has chosen not to run for re-election, instead endorsing Vice President Kamala Harris.

This unexpected move sets a significant precedent in the upcoming US election, which is a leadership race closely watched by global investors. Such a shift so late in the game may bring about concerns for investors. To this end, we aim to shed light on how the upcoming US election is factoring into our portfolio construction and asset allocation decisions. The short answer is very little.

We do not base our investment decisions on geopolitical or macroeconomic forecasts. While an event such as a presidential election can undoubtedly impact markets, forecasting the outcome accurately and positioning a portfolio to benefit from it is extremely difficult to do and has a very low chance of success. Today, we hold an underweight (relative to a market index) to US equities in our model portfolios, but this is a decision based on long-term valuations and fundamentals rather than an expression of any view as to who might win the election.

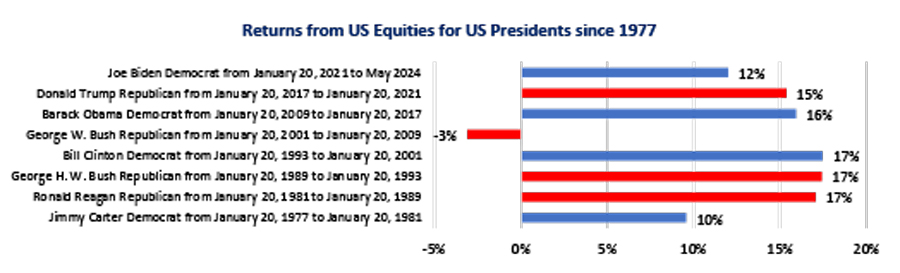

Consider the performance of the US stock market during the tenure of the last eight US presidents. As shown below, despite the immediate effect of elections on stock market performance, there’s a positive trend in the long run. Performance has tended to be strong regardless of the winning party, excluding that of George Bush Jr. In this instance, the period of his presidency contained two major bear markets (the dot com bubble and the Global Financial Crisis), which cannot be attributed directly to his policies.

Source: Financial Express, up until 23rd May 2024. The above are per annum in sterling and are based on the performance of a peer group of US equity fund managers, known as the Investment Association Sector.

We have also observed surprising or even contrary stock market performance when contextualized within incumbent policies. For example, renewable energy stocks performed better under Republican leadership (Trump) than under Democratic leadership (Biden), contrasting expected political support, while the opposite was true for oil and gas companies. While there are clear reasons for the strong performance of oil (the start of Russia-Ukraine war in 2022 being the obvious one), it is an example of a situation where policy doesn’t translate into the expected performance outcome.

Moreover, the White House’s occupant isn’t the sole determinant of future US government policy. The control of the Senate and the House of Representatives, too, play a pivotal role. However, studies show no significant relationship between party power and market performance, even in situations where one party has full control.

While elections might ruffle the market’s feathers in the short term, we focus on what is knowable—tilting portfolios towards assets that look cheap to us today because the price we pay today is the most important driver of future return. We stick to our process, build diversified portfolios, and monitor markets for potential opportunities that may well arise in the aftermath of such events.

Speak to the team: mps@fundhouse.co.uk

Fundhouse is the trading name of Fundhouse Bespoke Limited. Fundhouse provides investment management services to professional clients and does not provide financial advice. Importantly, this note does not represent investment advice, and any reader should always speak to their financial adviser before making any investment decisions. Please note that the value of any investment may go down as well as up, and you may lose capital when investing, and the value of your investments may not always increase. Please ensure that you are comfortable bearing financial losses and that you are comfortable taking a long-term investment view of five years or more.