Manager Research

We have a multi-award-winning fund manager research team that focuses on combining both qualitative and quantitative views into our process.

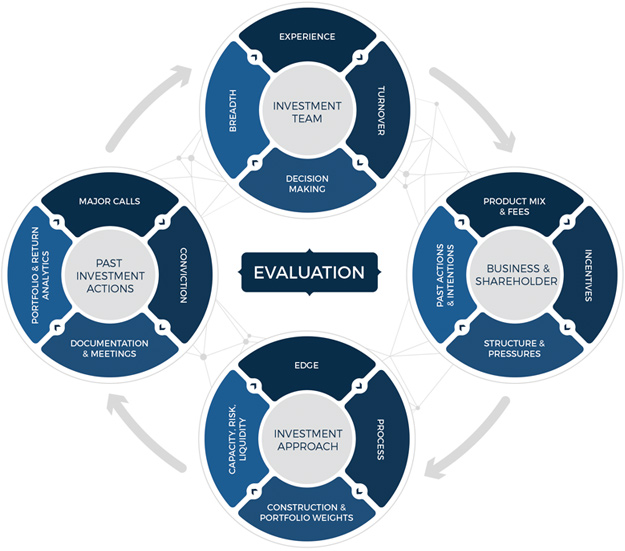

Below, we show our 16-factor process that acts as a long-standing guide to analysts.

Over time, our track record is strong; positively rated investment strategies have added good excess returns and negatively rated strategies have underperformed.

How We Evaluate Fund Managers

We are known for our detailed research that looks under the surface of funds and investment strategies and involves writing detailed reports based on our findings.

- We have a comprehensive track record tracking each rating

- Negative ratings save clients from poor funds

- We have a pioneering approach to using data to assess managers

- Often ex investors are involved in interviewing managers

- Each rating is peer-reviewed

- We leave no stone unturned

Why Fundhouse?

About Manager Research Ratings

- Tier Rating One

This is our top rating. We are satisfied that this offering is managed according to a well-considered process which is applied consistently and supported by the business, that we believe is likely to add value over time.

- Tier Rating Two

This is a good fund or strategy, however we have some minor concerns which may be related to people, process or business. In our view the odds of adding value remain positive, but not significantly.

- Tier Rating Two

This is a negatively rated strategy. We have one or more fundamental concerns about aspects of this strategy and believe there are better alternatives. We also believe the odds of this strategy adding value are low.

How We Select Funds to Rate

We aim to rate investment strategies which are in the best interests of our clients.

Our research is largely client driven, based on their needs, but we conduct an ongoing market assessment to see if there are additional investment strategies which we need to cover.

If you are a fund manager, please click here to see how best to interact with us

Currently we cover:

- Funds and separate accounts

- Onshore and offshore funds

- Open-ended and closed-ended strategies

- Single-asset class and multi-asset class strategies

- Alternatives

- Active and passives

- Strategies from large institutions as well as smaller boutiques

The Rating Process

We cover each investment strategy comprehensively by following the steps below

- Information Gathering

For each investment strategy we gather supporting information and evidence to be able to evaluate the management of the strategy. This includes detailed due diligence questionnaires completed by the fund manager, as well as our own research. We also perform analytical studies on each strategy using independent tools, and we evaluate the fund managers’ own analysis.

- Fund Manager Visit

We interact with, and visit fund managers, to test that the day-to-day management of the investment strategy is in line with what is expected and documented. We aim to avoid marketing presentations wherever possible, and prefer to drive these sessions through informed questioning. We aim to establish if a strategy is credibly managed, how the team works as a unit and various other elements which provide context.

- Rating Meeting

Each team member arrives at an independent assessment of the investment strategy. We then debate the rating elements until we have clarity on which Tier Rating should be allocated.

- Peer Review

For each investment strategy we gather supporting information and evidence to be able to evaluate the management of the strategy. This includes detailed due diligence questionnaires completed by the fund manager, as well as our own research. We also perform analytical studies on each strategy using independent tools, and we evaluate the fund managers’ own analysis.

- Review Process

We interact with, and visit fund managers, to test that the day-to-day management of the investment strategy is in line with what is expected and documented. We aim to avoid marketing presentations wherever possible, and prefer to drive these sessions through informed questioning. We aim to establish if a strategy is credibly managed, how the team works as a unit and various other elements which provide context.

- Fund Manager Feedback

Each team member arrives at an independent assessment of the investment strategy. We then debate the rating elements until we have clarity on which Tier Rating should be allocated.