Market Insight

What Next for Defensive and Cautious Investors After a Torrid 2022?

This Article was Written by: Rory Maguire - Fundhouse

Market Insights

2022 has been an incredibly difficult year for investors. Not only have we seen steep declines in equity markets, but this has been coupled with sharply rising bond yields.

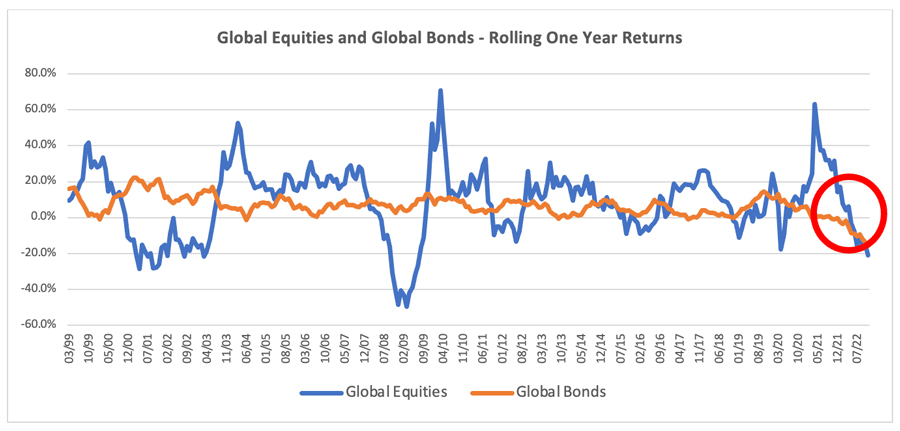

The negative correlation between equities and high-quality bonds that has served investors well in times of stress has broken down, leaving many investors holding cautious and defensive funds nursing losses similar to those seen in far higher risk portfolios. Does this shift in asset class behaviour mean that cautious investors need to rethink their approach?

An Unusual Environment for Cautious Funds

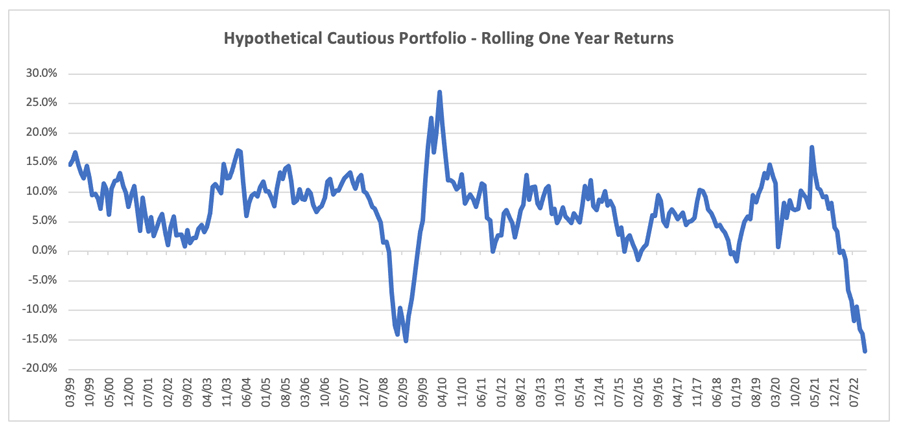

First, it is important to consider how rare the returns delivered in 2022 are for conservatively allocated investors. If we go back to 1999 – before the bursting of the tech bubble – and look at the one-year returns of a simple, hypothetical cautious portfolio (70% global bonds / 30% equities) * we can see how extreme the environment has been:

Losses are comparable with 2008 but have been generated in a very different manner. During the Global Financial Crisis equity returns were far worse, but some protection was provided by falling bond yields. In 2022, equity losses have not (yet) been comparable, but bond exposure has compounded investor problems, not mitigated them:

This is incredibly painful for cautious investors and has led to some results that are at the extreme end of reasonable expectations for this type of risk appetite. In such situations it is easy to make rash decisions, but it is crucial to reflect on what has happened and what the long-term implications may be.

A Valuation Windfall

Over recent years a combination of falling bond yields and rising equity valuations has meant that cautious investors earnt returns that were higher than might have been reasonably anticipated from the cash flow prospects of their investments. We can visualise this by looking at a simple yield-based expected return for the hypothetical cautious portfolio (calculated by combining the earnings yield on equities with the yield to worst on bonds)** with the subsequent five year return delivered:

The blue line is what we might have realistically anticipated our return to be, given the yield of equities and bonds, while the orange line is the realised five year performance from that point. The realised return is five years out (on the chart the orange line ends in 2017/18, as it is the return five years from that point until today). The gap between the two shows that returns have been consistently above a reasonable projection of what such an asset allocation might deliver. This has been caused – at least in part – by what Antti Ilmanen of AQR refers to as a valuation ‘windfall’ – a one-off return that occurs when asset class valuations become significantly more expensive over a certain holding period. This type of performance tailwind does not persist forever and can move in the opposite direction if assets become considerably cheaper – as we have seen with bonds this year.

Periods of unusually high returns are often a prelude to weaker returns in the future. Although the human tendency is to extrapolate strong past performance, we should instead be moderating our expectations.

If Not Long Duration Bonds, Then What?

The cautious and defensive funds that have been most susceptible to losses in 2022 have been those using long duration bonds as a significant portion of their low-risk asset allocation – particularly those with a passive or quasi-passive approach. This strategy has been incredibly successful and effective for several years but did lead to many portfolios increasing their duration sensitivity as yields continued to fall (higher risk and lower returns, the so-called ‘return free risk’ trade).

Given the environment the results from many cautious funds this year should not be surprising – it is entirely consistent with their design – but does the recent experience mean that the approach adopted requires a rethink?

Not necessarily. No investment approach works in every situation, and we must be realistic about the drawbacks of any strategy in which we invest.

Much of the pain this year has been caused by being exposed to long duration bonds in an uncommon environment of sharply rising bond yields and declining equity markets. What options do cautious investors have if they wish to avoid this type of scenario?

Market timing: They could attempt to adjust exposures based on an assessment of the prevailing market environment. The problem is such tactical approaches are incredibly difficult to do well. The track record of investors making consistently successful interest rate and bond yield forecasts is poor.

Valuation-led approach: Rather than predict when things will occur as in a market timing strategy, they could adjust duration sensitivity based on the risk-reward characteristics of fixed income. For example, holding a short duration position when the yield available relative to the interest rate sensitivity is unattractive. The challenge here is that they must wait for valuations to normalise, and that can be a long wait.

Short duration: One option, particularly considering higher cash rates, is to run with a far shorter level of duration in their fixed income exposure, leaving them less sensitive to a more prolonged change in the relationship between movements in equities and bonds. Although this is a prudent approach, there are two potential drawbacks. First, if investors are comparing the performance of their cautious fund with a simple passive alternative there will be a large duration mismatch – are they willing to accept the underperformance that might stem from that? Second, in a recessionary bear market for equities we might again see significant declines in bond yields and their short duration approach may well offer us less protection in such a scenario.

Non-bond diversification: When bonds are failing to diversify our portfolios, particularly in difficult market conditions, there is always a great temptation to look for other sources of diversification. While this is a great option in theory there are dangers. There is often a temptation to invest in complex strategies that we do not truly understand, or asset classes that are not genuinely diversifying but simply look it because they are illiquid and have stale, mark to model pricing. Both scenarios lead to the assumption of a whole new host of risks.

As our tendency is to compare the (short-term) results of our cautious fund to a simple passive (equity / bond) comparator, adopting any of these approaches would have in all likelihood come with a prolonged and considerable performance cost in recent years. This does not mean all these methods are inferior, but investors need to be willing to bear the periods of underperformance that will inevitably occur.

There is a real danger that as investors we extol the virtues of a particular fund when it is delivering (often ignoring the inherent risks) and then abandon it when we are surprised by a period of poor performance. We are prone to adjust our fund holdings to deal with the risk that has just been realised, rather than those that may come to pass in the future. Consistently repeating this behaviour is likely to erode returns through time.

Deteriorating Performance and Improving Valuations

Given recent market performance there is a great deal of speculation about the negative correlation between equites and bonds that we have witnessed in recent decades being broken and becoming an artefact of an era defined by persistently falling bond yields. Whilst this is possible, it is extraordinarily difficult to predict with any level of conviction.

Rather than attempt to make such heroic forecasts, it is more prudent to look at areas where we can have greater confidence. The weakness in bonds and equities through 2022 means that our expected long-term returns for a typical cautious portfolio have improved significantly:

Unfortunately such valuation measures provide very little guide to the short-term outlook for cautious investors, but higher bond yields and lower equity prices do increase the probability of improved returns as we extend our time horizon.

Whichever approach to cautious investing we adopt, we need to understand both its benefits and limitations, and then decide whether we are behaviourally disposed to sticking with those for the long-term.

* The hypothetical cautious portfolio is comprised of a 70% allocation to a global aggregate bond index (USD hedged) and a 30% allocation to a global equity index. All returns in USD.

** This is a very simple model combining the earnings yields of equities and the yield to worst on bonds. It is meant to be instructive rather than a precise forecast.

Speak to the team: mps@fundhouse.co.uk.

Fundhouse is the trading name of Fundhouse Bespoke Limited. Fundhouse provides investment management services to professional clients and does not provide financial advice. Importantly, this note does not represent investment advice, and any reader should always speak to their financial adviser before making any investment decisions. Please note that the value of any investment may go down as well as up, and you may lose capital when investing, and the value of your investments may not always increase. Please ensure that you are comfortable bearing financial losses and that you are comfortable taking a long-term investment view of five years or more.